Product Details

Category - Textbook/Educational Curriculum / College & Above

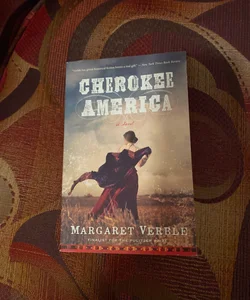

Format - Hardcover

Condition - Excellent

Listed - 7 months ago

Views - 7

Wishes - 1

Ships From - Michigan

Est. Publication Date - Dec 1996

Seller Description

The past twenty years have seen an extraordinary growth in the use of quantitative methods in financial markets. Finance professionals now routinely use sophisticated statistical techniques in portfolio management, proprietary trading, risk management, financial consulting, and securities regulation. This graduate-level textbook is intended for PhD students, advanced MBA students, and industry professionals interested in the econometrics of financial modeling. The book covers the entire spectrum of empirical finance, including: the predictability of asset returns, tests of the Random Walk Hypothesis, the microstructure of securities markets, event analysis, the Capital Asset Pricing Model and the Arbitrage Pricing Theory, the term structure of interest rates, dynamic models of economic equilibrium, and nonlinear financial models such as ARCH, neural networks, statistical fractals, and chaos theory. Each chapter develops statistical techniques within the context of a particular financial application. This exciting new text contains a unique and accessible combination of theory and practice, bringing state-of-the-art statistical techniques to the forefront of financial applications. Each chapter also includes a discussion of recent empirical evidence, for example, the rejection of the Random Walk Hypothesis, as well as problems designed to help readers incorporate what they have read into their own applications.

Overview

The Econometrics of Financial Markets

ISBN: 9780691043012

Publisher Description

The past twenty years have seen an extraordinary growth in the use of quantitative methods in financial markets. Finance professionals now routinely use sophisticated statistical techniques in portfol...

Read more

Tags